Panels

DigiBankFlex includes four distinct panels designed for specific roles within the digital banking ecosystem:

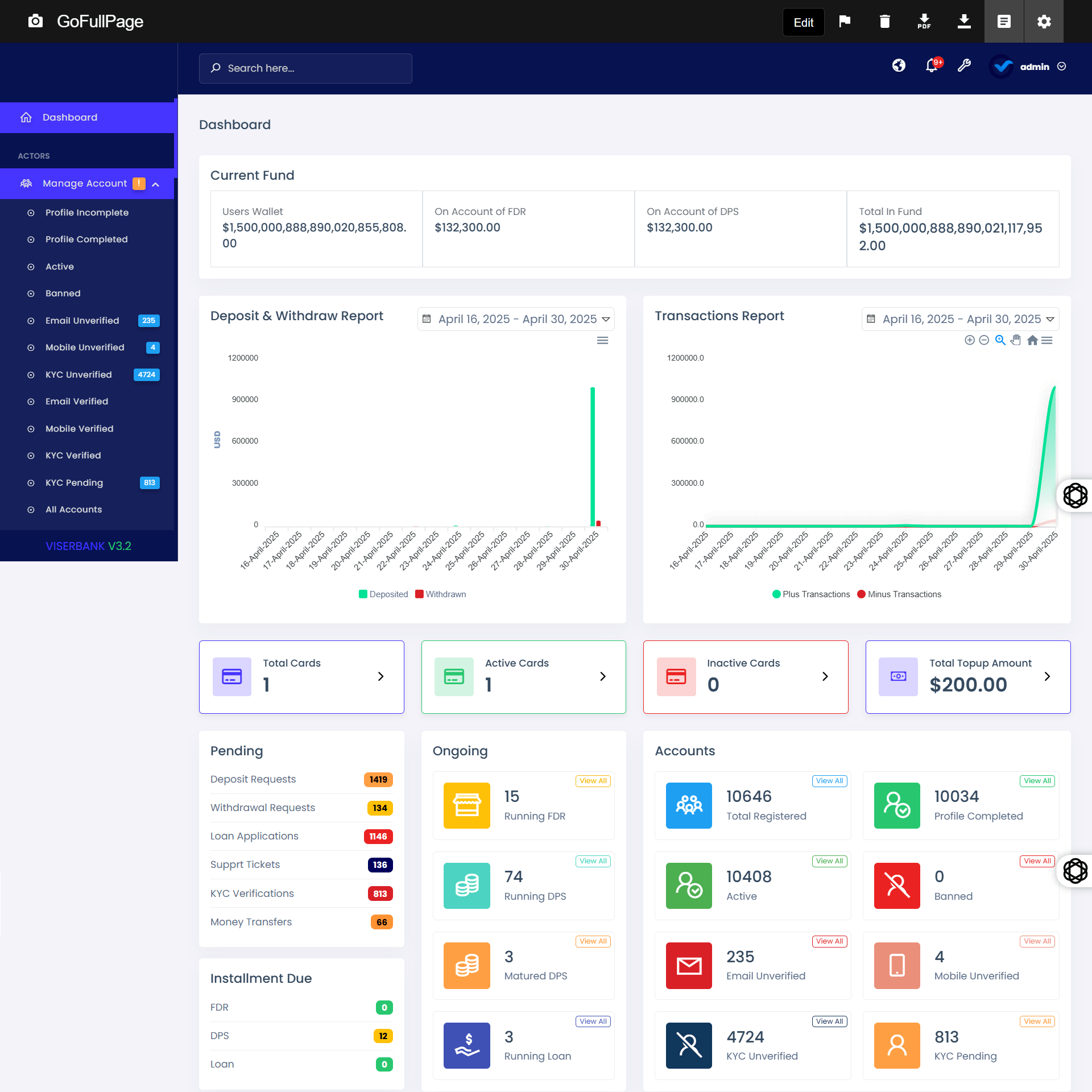

Admin Panel

- Super admin access to configure, manage, and monitor the entire platform.

- Role and permission control for staff and other panel users.

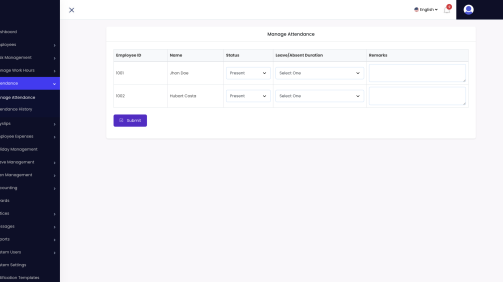

Staff/Branch Panel

- Designed for bank staff or branch managers.

- Allows customer support, manual processing, document verification, and transaction approvals.

User Panel (Customer Panel)

- For individual or business users to manage their financial accounts.

- Access deposits, transfers, loans, statements, profile, and KYC.

Frontend Website Panel

- Public-facing website with product info, FAQs, contact forms, login, and registration.

- Includes multilingual and SEO-ready pages, blog sections, and company policy displays.

—————————————————–

🏦 Core Banking Functionalities

- Full user registration and KYC verification system

- Unlimited users, accounts, transactions, and plans

- Deposit, Withdraw, Transfer, and Loan modules

- Fixed Deposit Receipt (FDR) system

- Deposit Pension Scheme (DPS) with installment options and delay charges

- Beneficiary management for internal and external bank transfers

- Wire bank transfer support

- Loan applications and installment payments

- Due installment handling for both DPS and Loans

- Installment delay charges

- Interest calculations for FDR and DPS

- Branch and Branch Staff management

💳 Payment Gateways (20+ Supported)

- Card payments

- Cryptocurrency payments

- Mobile money payments

- Manual payment gateways with currency support

🛡 Security and Compliance

- GDPR policy compliant

- OTP verification system

- reCAPTCHA in contact forms

- Role-based permission control

- Idle user auto-logout

- Login history tracking

- Secure KYC system with data view and verification

- Security vulnerability patches

- Server error fixes (500 errors and redirects)

- Banned page for restricted staff

📊 Admin Features

- Powerful and modern admin panel

- Configure global system settings, currency format, and pagination

- Virtual card generation

- SEO configuration (robots.txt, sitemap, policy page content)

- Slug management for policy and static pages

- Notification system (user and filtered groups)

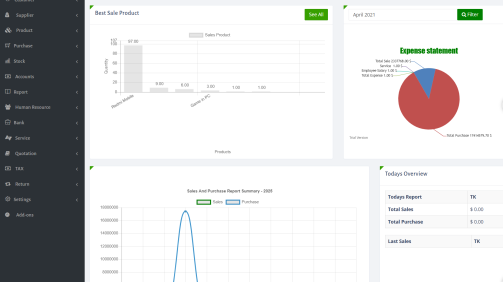

- Insightful admin dashboard: grouped analytics, filterable charts for deposits, withdrawals, transactions

- Table customization: export (CSV/Excel/PDF), sorting, filtering, column selection

- Search by names, roles, cities, etc., across users, staff, accounts, branches

- Maintenance mode image uploads

- Upload logos for payment/withdrawal methods

- View login as user, login history, and send notifications directly from admin panel

- Configure cron jobs (restricted to super admin)

🧾 Statements & Reporting

- Download statements (user and branch staff panel)

- Configurable fee for branch staff statement downloads

- Export reports in PDF/CSV

- Account-wise, date-wise filters for reports

- Transaction history with advanced filters (date range, amount, etc.)

- Support ticket tracking with account number and opened date

📲 User Features

- Profile management

- KYC submission and tracking

- Deposit, transfer, and withdraw with real-time balance view

- Mobile top-up (formerly Airtime) through third-party API

- Download account statements

- Multi-language support

- Login with Google, Facebook, LinkedIn

- Referral system with commission and count limit

- Push notifications

- Resend code countdown on OTP/verification pages

🖼 Design & UI Enhancements

- Modern responsive UI with multiple frontend templates

- Admin UI for better UX (menus, forms, dashboards)

- Drag-and-drop image uploader

- Dynamic Form generator:

- Input types: number, URL, date, time

- Width configuration

- Hints/instructions

- Sorting of fields

- Search and pagination

- Modern Notification toaster and support ticket attachment UI

- Centralized settings system

- Google Analytics integration